DYNEX CAPITAL (DX)·Q4 2025 Earnings Summary

Dynex Capital Delivers 29% Total Return in 2025 as Book Value Climbs to $13.45

January 26, 2026 · by Fintool AI Agent

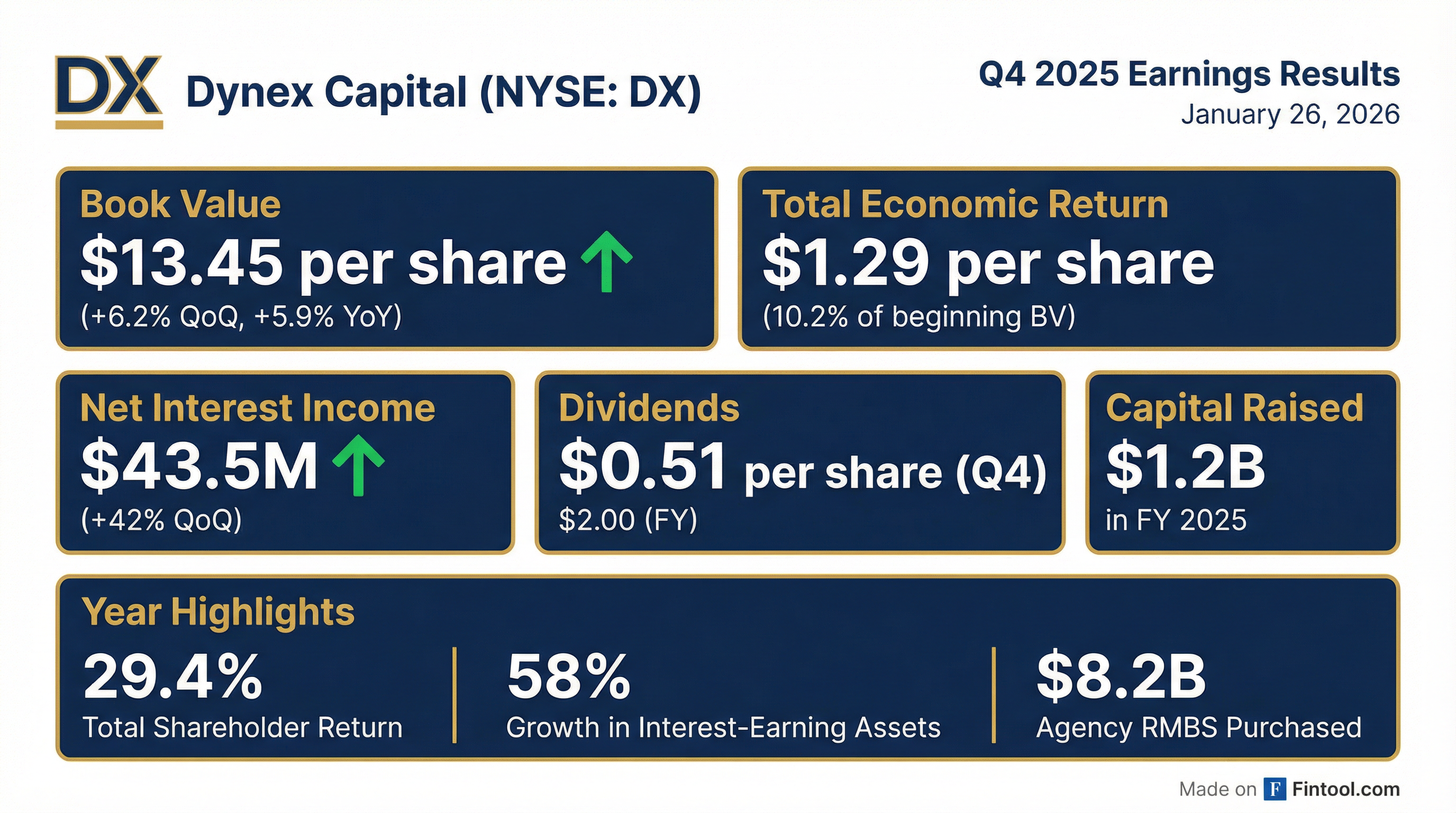

Dynex Capital (NYSE: DX) reported Q4 2025 results that exceeded expectations on book value and net interest income while delivering a standout year for shareholders. Book value per share rose to $13.45, up 6.2% sequentially and 5.9% year-over-year, beating consensus estimates by nearly 8%. The mortgage REIT generated a total economic return of $1.29 per share (10.2% of beginning book value) for Q4 and $2.75 per share (21.6%) for full year 2025.

Did Dynex Beat Earnings?

The key story is book value appreciation — Dynex's book value increased $0.78 per share in Q4, driven by strong asset appreciation as Agency MBS spreads tightened. Combined with the $0.51 dividend, this produced the $1.29 total economic return.

Net interest income surged 42% quarter-over-quarter to $43.5 million, benefiting from lower repurchase agreement financing rates following three Fed rate cuts in 2025 and a larger portfolio base. On a non-GAAP basis, Economic Net Interest Income reached $51.1 million in Q4, up 172% year-over-year from $18.8 million in Q4 2024:

What Did Management Say?

Smriti Popenoe, Co-CEO and President:

"2025 was a strong year for Dynex. We delivered a 29.4% total shareholder return and a 67% decade-long total return, driven by disciplined execution and rigorous risk management. Our market capitalization nearly tripled over the last 13 months as we raised and deployed capital into attractive opportunities, while strengthening our organization with refreshed leadership, a new independent auditor, and an expanded office footprint."

Byron Boston, Chairman and Co-CEO:

"Reflecting the company's significant growth, commitment to building resilience and evolving our human capital to align with our vision, we are expanding the breadth and depth of our executive team by separating the roles of Chief Financial Officer and Chief Operating Officer."

Strategic Positioning

Management outlined five key pillars for value creation:

- Income & New Regime: Mortgage spreads remain wide enough vs. swaps to generate compelling leveraged ROEs, with potential for greater tightening given GSE backstop support

- Well Positioned: Existing portfolio can drive significant spread income and realize gains from further tightening

- High Liquidity: Operating with $1.4 billion of cash and unencumbered assets (58% of equity) to protect in volatile periods

- Policy Tailwinds: Lighter regulation, policymaker bias towards housing affordability, and Fed bias towards less restrictive policy

- Experience: Seasoned team with experience from prior regimes where agency portfolios dominated supply-demand balance

What Changed This Quarter?

Capital Deployment Acceleration: Dynex purchased $3 billion in Agency RMBS and $284 million in Agency CMBS during Q4 alone, bringing 2025 totals to $8.2 billion and $1.2 billion respectively. The average balance of interest-earning assets increased 58% during 2025.

Financing Cost Improvement: Repurchase agreement financing costs declined from 4.44% in Q3 to 4.10% in Q4, expanding net interest spread from 0.46% to 0.75%.

Leadership Expansion: Meagan Bennett was hired as Chief Operating Officer, a seasoned operator with deep financial and operational expertise from Fannie Mae, Morgan Stanley, GE Capital, and a U.S. Navy veteran. Rob Colligan will continue as CFO with expanded duties including building out corporate development capabilities.

Full Year 2025 Performance

*Estimated based on interest-earning asset growth

Portfolio Composition

Dynex's portfolio grew substantially, with total MBS investments reaching $19.4 billion at fair value as of December 31, 2025 (vs. $15.8B at Q3 end):

The RMBS coupon distribution shows diversification across the stack:

Management emphasized the importance of diversified coupon exposure given potential for lower mortgage rates.

Balance Sheet & Leverage

The share count more than doubled year-over-year as Dynex aggressively raised capital through ATM issuances, all at premiums to book value.

Hedging Portfolio

Dynex maintains an active hedging program using interest rate swaps and Treasury futures:

The swap portfolio expanded from $7.9B to $9.7B quarter-over-quarter, reflecting larger hedging needs as the asset base grew.

Tax Considerations

REIT taxable income for 2025 is estimated at $229 million, including ~$100 million of deferred tax hedge gains amortization. The company has $558 million in net deferred tax hedge gains to be recognized over the coming years, providing visibility into future distribution requirements.

Historical Performance Context

From the Q3 2025 earnings call, management noted that Agency RMBS continues to offer high-teens ROEs net of hedging costs, with gross returns potentially reaching mid-20s on select coupons. The team emphasized their "raise and deploy" strategy throughout 2025, capitalizing on wide Agency MBS spreads relative to historical levels when measured against interest rate swaps.

*Values retrieved from S&P Global

Forward Outlook

Management enters 2026 "resilient and focused on shareholders."

Key Macro Themes for 2026

Management outlined six key macroeconomic themes they're monitoring:

-

Government Policy: Domestic policy shifts focused on improving cost of living, with federal focus on bringing down mortgage rates. Expect rapid reforms with potential unintended consequences.

-

GSE Balance Sheet Return: The presidential directive for GSEs to buy $200 billion of mortgages marks the return of a native balance sheet for mortgages and should provide a backstop against material spread widening.

-

Fed Policy: Fed policy will likely continue to be pressured by politicians. Bias appears towards lower nominal policy rates, though volatility in forward expectations could increase. Rate policy transmission could shift toward repo-based rates, supportive for mortgage repo funding.

-

Fiscal Policy: $2T+ deficits in the US seem likely with upside risks. Defense spending likely to surge. US Treasury policy could increasingly target Dollar and manage debt maturities.

-

System Liquidity: Liquidity remains abundant. Lighter regulation including lower capital requirements could ease liquidity flow in dollar financing markets.

-

Demographics & Tech: Persistent global demographic trends support demand for income. Housing demand shaped by millennial and Gen Z household formation. AI-powered underwriting transforming mortgage origination.

Interest Rate Sensitivity

The slides provide detailed sensitivity analysis:

The portfolio is more sensitive to rate declines than increases due to convexity characteristics of the MBS portfolio. Management noted a regime shift for mortgage spreads to swaps is possible with GSE portfolio growth.

Key Risks

- Interest Rate Volatility: Sharp rate moves could impact book value through MBS repricing — a 100bp rate decline would reduce book value by 9.6%

- Swap Spread Risk: More negative swap spreads could pressure relative value

- Prepayment Acceleration: Lower mortgage rates could drive faster prepayments, impacting premium amortization

- Equity Dilution: Continued ATM issuances, while accretive to book value, have significantly expanded share count

- Global Uncertainty: Management highlights a potential "rupture" in post-war international order, with political rivalry and economic coercion altering global trade

Post-Quarter Update (As of January 23, 2026)

Management provided updated metrics through the earnings call:

The book value increase reflects continued spread tightening into 2026, with MBS spreads tightening 150-300 basis points depending on coupon since Q3 2025.

Q&A Highlights

On Forward Returns (Doug Harter, UBS):

Management outlined current return expectations:

- Mid-teens hedged ROEs at current 7x leverage

- Mid-to-high teens ROEs with targeted leverage in low 8x range

- These are carry ROEs that assume no additional spread tightening

"The dynamic is roughly, depending on the coupon, between 150 and 300 basis points tighter than it was at the end of last quarter." — Rob Colligan

On Risk-Reward After Spread Tightening:

Smriti Popenoe addressed concerns about returns after significant spread compression:

"Before the GSE balance sheets were announced as being active participants, you did have the risk of spreads widening significantly... What this does is it really takes a big part of that tail risk out. So yes, returns are lower, but also the ability for spreads to widen out a whole bunch... has also improved what I think of as the risk-return profile going forward."

On GSE Policy & Housing Affordability (Trevor Cranston, Citizens JMP):

Management confirmed they are prepared for potential policy interventions:

- G-fee reductions are being discussed

- Loan-level pricing adjustments could be removed

- ARM market could return to favor in a steep yield curve environment

- Prepayment-protected mortgages are being discussed again

"Government policy can create both risk and opportunity at the same time, and this is what we're ready to be investing in." — Smriti Popenoe

On Portfolio Deployment (Trevor Cranston, Citizens JMP):

TJ Connolly noted investment opportunities across the coupon stack:

- Primary focus: 5s and 5.5s coupons

- Finding specified pool opportunities across coupons not traded in several quarters

- Emphasis on durable call protection

On GSE Balance Sheet Cap (Bose George, KBW):

"I've never seen before tweets from someone like the FHFA or a report from someone like that in history that focused on mortgage spreads. Not just mortgage rates, but on mortgage spreads. That is a very different thing... It's hard for me to see how $200 billion is necessarily the cap. I think it could be significantly more." — TJ Connolly

On Spread Regime (Bose George, KBW):

Management sees potential for spreads to return to pre-financial crisis levels:

"There's a really good case to be made that you can return to a tighter spread regime, much more like we saw throughout the late 1990s and into the early 2000s... It's really about the backstop and the support from the government that you're potentially getting allows all investors to take more risks."

On Hedge Book Composition (Jason Stewart, Compass Point):

TJ Connolly detailed the hedging approach:

- Current mix: ~2/3 interest rate swaps, ~1/3 Treasuries

- May shift to 60-80% swaps range

- Swaps offer significant carry advantage vs Treasuries

- Curve position is more balanced (less steepening bias than before)

On the "Unusual" Prior Environment (Rob Colligan):

"The environment that we are coming from, that we've just come from, is the unusual environment. To see agency MBS spreads at those levels, 150, 160, 180 over Treasuries — those are unusual environments... What we're coming back to is really how things have been for most of the time in this housing finance system."

On G&A Run Rate (Jason Weaver, JonesTrading):

Rob Colligan confirmed expense expectations:

- G&A at ~2% of capital for now

- Q4 increase driven by performance-related compensation accruals

- Additional hires planned which could impact run rate

- Further scale efficiencies possible but not expected immediately in 2026

On Government Intervention & Fed Pressure (Eric Hagen, BTIG):

Management is prepared for continued policy intervention:

"It's not unusual in these types of situations for there to be explicit efforts to influence monetary policy and other policy, including what mortgage rates are gonna be... We believe there's a high probability of that happening, and we are preparing for that." — Smriti Popenoe